|

California Code of Regulations (Last Updated: August 6, 2014) |

|

Title 18. Public Revenues |

|

Division 2.5. State Controller |

|

Chapter 1. Inheritance Tax |

|

Article 6. Valuation |

§ 13953. Tables.

Latest version.

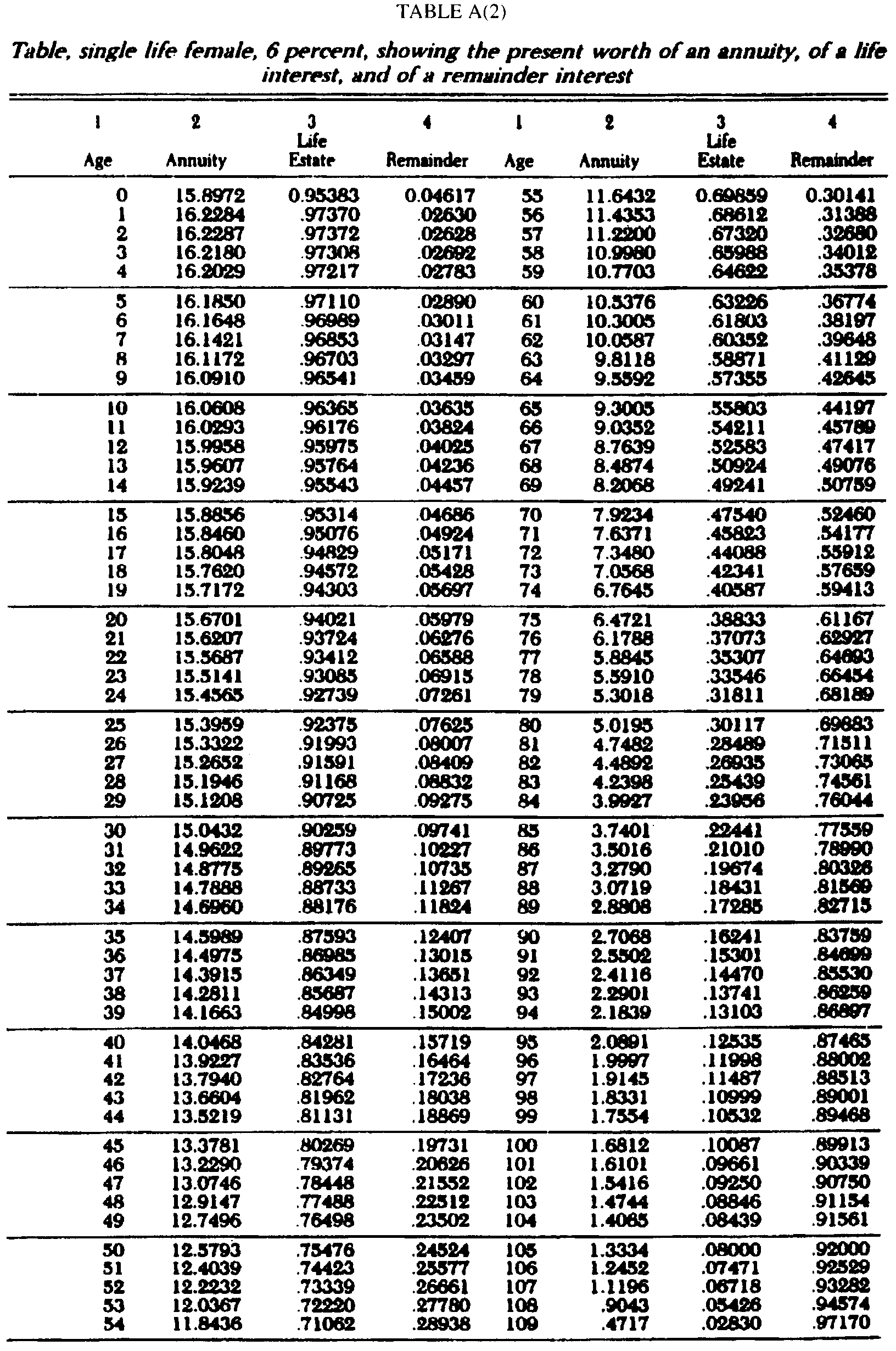

- (a) Tables A(1) and A(2) showing the present value of an annuity, a life estate and a remainder of $1 per year during the life of a person of a specified age, based on United States Life Tables: 1959-1961, published by the United States Department of Health, Education and Welfare, Public Health Service, with interest at 6 percent per annum compounded annually.CAUTION: The tables immediately following are effective as to estates of decedents dying on or after January 1, 1975. For decedents dying prior to January 1, 1975, but on or after November 10, 1969, refer to Tables C and D, contained in Section 13953.1. For decedents dying prior to November 10, 1969, use Actuaries Combined Experience Tables of Mortality with interest at 4 percent, showing present value of annuity of $1 per year during life of person of specified age, if date of death was on or after July 1, 1945. For decedents dying prior to July 1, 1945, use Actuaries Combined Experience Tables of Mortality with interest at 5 percent, showing present value of annuity of $1 per year during life of person of specified age.TABLE A(1)Table, single life male, 6 percent, showing the present worth of an annuity, of a life interest, and of a remainder interest12341234AgeAnnuityLife EstateRemainderAgeAnnuityLife EstateRemainder015.61750.937050.032955510.29600.617760.38224116.0362.96217.037835610.0777.60466.39534216.0283.96170.03830579.8552.59131.40869316.0089.96053.03947589.6297.57778.42222415.9841.95905.04095599.4028.56417.43583515.9553.95732.04268609.1743.55052.44948615.9233.95540.04460618.9478.53687.46313715.8885.95331.04669628.7202.52321.47679815.8505.95105.04895638.4924.50534.49046915.8101.94861.05139648.2642.49385.504151015.7663.94598.05402658.0353.48212.517881115.7194.94316.05684667.8060.46836.531641215.6898.94019.05981677.5763.45458.545421315.6180.93708.06292687.3462.44077.559231415.5651.93391.06609697.1149.42689.573111515.5115.93069.06931706.8823.41294.587061615.4576.92746.07254716.6481.39889.601111715.4031.92419.07581726.4123.38474.615261815.3481.92089.07911736.1752.37051.629491915.2918.91751.08249745.9373.35624.643762015.2339.91403.08597755.6990.34194.638062115.1744.91046.08954765.4602.32761.672392215.1130.90678.09328775.2211.31327.686732315.0487.90292.09708784.9825.29895.701052414.9807.89884.10116794.7469.28481.715192514.9075.89445.10555804.5164.27098.729022614.8287.88972.11028814.2955.25773.742272714.7442.88465.11535824.0879.24527.754732814.6542.87925.12075833.8924.23354.766462914.5588.87353.12647843.7029.22217.777833014.4384.86750.13250853.5117.21070.789303114.3528.86117.13883863.3259.19955.800453214.2418.85451.14349873.1450.18820.811303314.1254.84732.15248882.9703.17822.821783414.0034.84020.15980892.8052.16831.831693513.8758.83255.16745902.6536.15922.840783613.7425.82455.17545912.5162.15097.849033713.6026.81622.18378922.3917.14350.856503813.4591.80755.19245932.2801.13681.863193913.3090.79854.20146942.1802.13081.889194013.1538.78923.21077952.0691.12335.874654112.9934.77960.22040961.9997.11998.800024212.8279.76967.23033971.9145.11487.885134312.6574.75944.24056981.8331.10999.890014412.4819.74891.25109991.7354.10532.894684512.3013.73808.261921001.6812.10087.899134612.1158.72695.273051011.6101.09661.903394711.9253.71552.284481021.5416.09250.907504811.7308.70385.296251031.4744.08846.911544911.5330.69198.308021041.4065.08439.915615011.3329.67997.320031051.3334.08000.920005111.1308.66785.332151061.2452.07471.925205210.9267.65560.344401071.1196.06718.932825310.7200.64320.35680108.9043.05426.945745410.5100.63080.36940109.4717.02830.97170TABLE A(2)Table, single life female, 6 percent, showing the present worth of an annuity, of a life interest, and of a remainder interest12341234AgeAnnuityLife EstateRemainderAgeAnnuityLife EstateRemainder015.89720.953830.046175511.64320.698590.30141116.2284.97370.026305611.4353.68612.31388216.2287.97372.026285711.2200.67320.32680316.2180.97308.026925810.9980.65988.34018416.2029.97217.027835910.7703.64622.35378516.1850.97110.028906010.5376.63226.36774616.1648.96889.030116110.3005.61803.38197716.1421.96853.031476210.0587.60352.30648816.1172.96703.03297639.8118.58871.41129916.0910.96541.03459649.5592.57355.426451016.0608.96365.03635659.3005.55803.441971116.0293.96176.03824669.0352.54211.457891215.9958.95975.04025678.7639.52583.474171315.9607.95764.04236688.4874.50924.490761415.9239.96543.04457698.2068.49241.507591515.8856.96314.04686707.9234.47540.524601616.8460.95076.04924717.6372.45823.541771715.8048.94829.05171727.3480.44088.559121815.7620.94572.05428737.0568.42341.576591915.7172.94303.05697746.7645.40587.594132015.6701.94021.05979756.4721.38833.611672115.6207.93724.06276766.1788.37073.629272215.5887.93412.06588775.8845.35307.648932315.5141.93085.08915785.5910.33546.664542415.4565.92739.07261795.3018.31811.681892515.3959.92375.07625805.0195.30117.698832615.3322.91993.08007814.7482.28489.715112715.2652.91591.08409824.4892.26935.730652815.1946.91165.08832834.2398.25439.745612915.1208.90725.09275843.9927.23956.760443015.0432.90259.09741853.7401.22441.775593114.9622.89773.10227863.5016.21010.789903214.8775.89265.10735873.2790.19674.803263314.7888.88733.11267883.0719.18431.815693414.6960.88176.11824892.8808.17235.827153514.5989.87593.12407902.7068.16241.837593614.4975.86965.13015912.5502.15302.846993714.3915.86349.13651922.4116.14470.855303814.2811.85687.14313932.2901.13741.862593914.1663.84998.15002942.1839.13103.868974014.0468.84281.15719952.0891.12535.874654113.9227.83536.16464961.9997.11998.880024213.7940.82764.17236971.9145.11487.885134313.6604.81962.18038981.8331.10999.890014413.5219.81131.18869991.7554.10532.894684513.3781.80269.197311001.6812.10087.899134613.2290.79374.206261011.6101.09661.903394713.0746.78448.215521021.5416.09250.907504812.9147.77488.225121031.4744.08846.911544912.7496.76498.235021041.4065.08439.915615012.5793.75476.254241051.3334.08000.920005112.4039.74423.255771061.2452.07471.925295212.2232.73339.266611071.1196.06718.932825312.0367.72220.27780108.9043.05426.945745411.8436.71062.28938109.4717.02830.97170(b) Table B showing the present value of an annuity for a term certain, income for a term certain and of a remainder interest postponed for a term certain, based on United States Life Tables: 1959-1961, published by the United State Department of Health, Education and Welfare, Public Health Service, with interest at 6 percent per annum.(Effective as to decedents dying on or after January 1, 1975.)TABLE BTable showing the present worth at 6 percent of an annuity for a term certain, of an income interest for a term certain, and of a remainder interest postponed for a term certain12341234No.TermNo.TermofAnnuityCertainRemainderofAnnuityCertainRemainderYearsYears10.9434.056604.9433963113.9291.835745.16425521.8334.110004.8899963214.0840.845043.15495732.6730.160381.8396193314.2302.853814.14618643.4651.207906.7920943414.3681.862088.13791254.2124.252742.7472583514.4982.869895.13010564.9173.295039.7049613614.6210.877259.12274175.5824.334943.6650573714.7368.884207.11579386.2098.372588.6274123814.8460.890761.10923996.8017.408102.5918983914.9491.896944.103056107.3601.441605.5583954015.0463.902778.097222117.8869.473212.5267884115.1380.908281.091719128.3838.503031.4969694215.2245.913473.096527138.8527.531161.4688394315.3062.918370.081630149.2950.557699.4423014415.3832.922991.077009159.7122.582735.4172654515.4558.927350.0726501610.1059.606354.3936464615.5244.931462.0685381710.4773.628636.3713644715.5890.935342.0646581810.8276.649656.3503444815.6500.939002.0609981911.1581.669487.3305134915.7076.942454.0575482011.4799.688195.3118055015.7619.945712.0542882111.7641.705845.2941555115.8131.948785.0512152212.0416.722493.2775055215.8614.951684.0483162312.3034.738203.2617975315.9070.954418.0455822412.5504.753021.2489795415.9500.956999.0430012512.7834.767001.2329995515.9905.959433.0405672613.0032.780190.2198105616.0288.961729.0382712713.2105.792632.2073695716.0649.963895.0361052813.4062.804370.1956305816.0900.965939.0340612913.5907.815443.1845575916.1311.967867.0321333013.7648.825890.1741106016.1614.969686.030314(c) Adjustment Factors for Annuities Payable at Regular Intervals of Less Than One Year.If a life annuity or an annuity certain is payable at the end of semiannual, quarterly, monthly or weekly periods, the following adjustment factors should be used:Semiannual1.0148Quarterly1.0222Monthly1.0272Weekly1.0291If an annuity for a term certain is payable at the beginning of the annual or other payment period, the following adjustment factor should be used:Annual1.0600Semiannual1.0448Quarterly1.0372Monthly1.0322Weekly1.0303However, a provision that the income from property is to be paid in semiannual, quarterly, bimonthly, monthly or weekly installments does not affect the value to be assigned to the life interest.

Note

Note: Reference: Section 13953, Revenue and Taxation Code.